It Sometimes Helps to Seek a Broader Perspective

Posted February 07, 2014

Author – David C. King, President & CEO, Horst Insurance

Pricing for Commercial Property & Casualty Insurance continues to rise, albeit at a slower pace. And, while we certainly understand that no business leader wants to see the cost of doing business on the rise, it helps to sometimes step back and take a wider perspective on things. That is certainly the case when it comes to the commercial insurance cycle.

Most business leaders have seen at least two or three major insurance pricing cycles during their career. I have been in the business for 27 years and have seen four distinct cycles during that time. And, while the scale and duration of each cycle varies, one thing is for sure – cycles run their course and then reverse. They always have and likely always will.

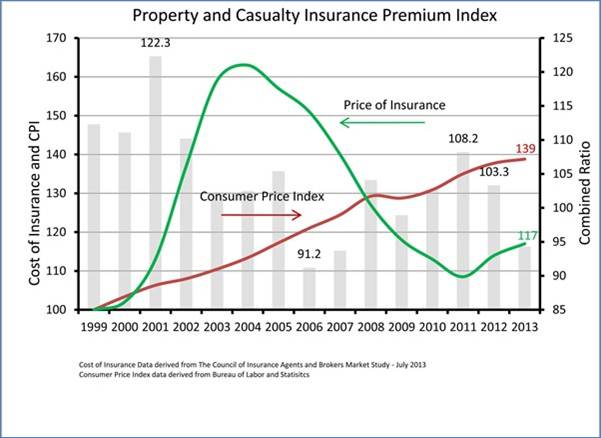

The graph below, published by the Council of Insurance Agents and Brokers – July 2013, illustrates the Property and Casualty Premium cycle over the last 15 years. I really like this chart because it shows not only the pricing trend, but also includes CPI and Loss Ratio (premiums to losses paid) information:

Particularly noteworthy in this chart are the following:

- The “cost of insurance” fell rapidly from 2003 until 2011

- CPI rose steadily during that same period

- Loss ratios have only been below 100% four years out of the last fifteen.

- Cost of insurance, as an index, has barely gotten back to 2001 levels in 2013

- Current rate of increase is more moderate than the last upswing from 2000 through 2003

So, when you step back and look more widely at the property and casualty pricing cycle, versus looking at just your latest renewal, you begin to see a different perspective that only time provides. Again, no one needs “perspective” when you are writing checks in today’s real dollars. However, there aren’t many costs incurred by a business that are at 2001 pricing levels in 2014.

Each and every day, Horst Insurance’s Property & Casualty Teams diligently work to make sure that you receive the greatest value for your premium costs. Those same teams carefully monitor the market cycle and stand ready to ensure that your insurance costs remain manageable regardless of which direction the market is heading.